The 3-week tipping point: How activity duration impacts flow

We’ve all heard the phrase “slow and steady wins the race.” But is that actually true in repeatable residential construction? Our team set out to find out, and what we found surprised us.

In repeatable residential projects like apartments and high-rises, speed isn’t the enemy of quality. In fact, it’s often one of the strongest predictors of steady production and ‘flow’.

After analyzing activities across dozens of projects, a clear pattern emerged. When a trade completes its scope on a single floor in a focused 1–3 week push, they’re far more likely to finish without gaps or stop-start interruptions. But once that same work stretches beyond 3 weeks, momentum fades, and the workflow begins to fragment – creating pauses, return visits, and disruption to the overall flow of the build.

Defining key terms: ‘First Pass Complete’ and ‘flow’

In high-rises and other repeatable residential projects, a core operational goal is flow – the continuous, uninterrupted movement of trades up the building.

A key metric that supports flow is First Pass Complete. In this context, First Pass Complete measures whether a trade can complete its scope on a floor (or any other defined area) in one continuous push, without pauses, stops, or production gaps.

Why does this matter?

Low First Pass Complete is dangerous because it breaks flow.

If a trade can’t complete work in a single continuous push, they leave unfinished work areas behind. This creates a stop-start cycle, preventing subsequent trades from getting started in an area and disrupting the rhythm of the entire vertical schedule.

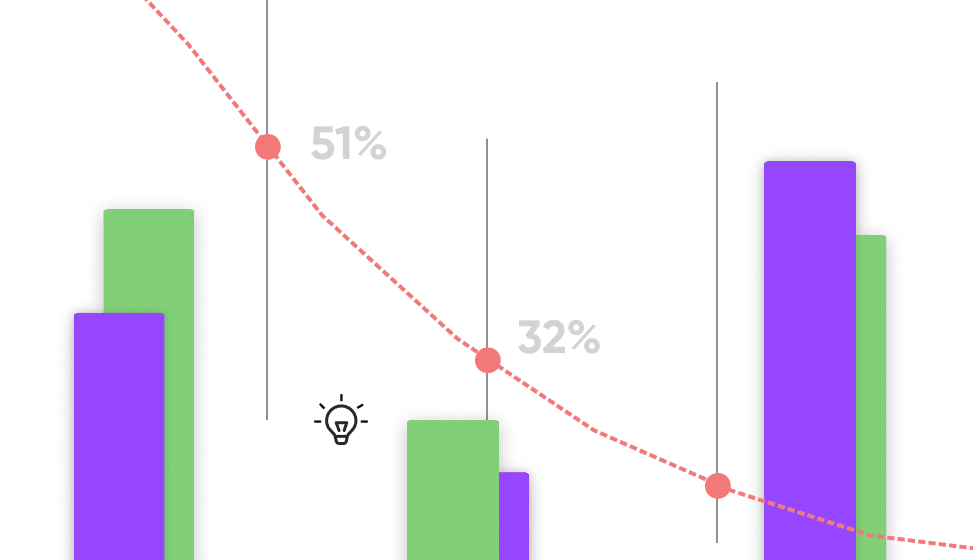

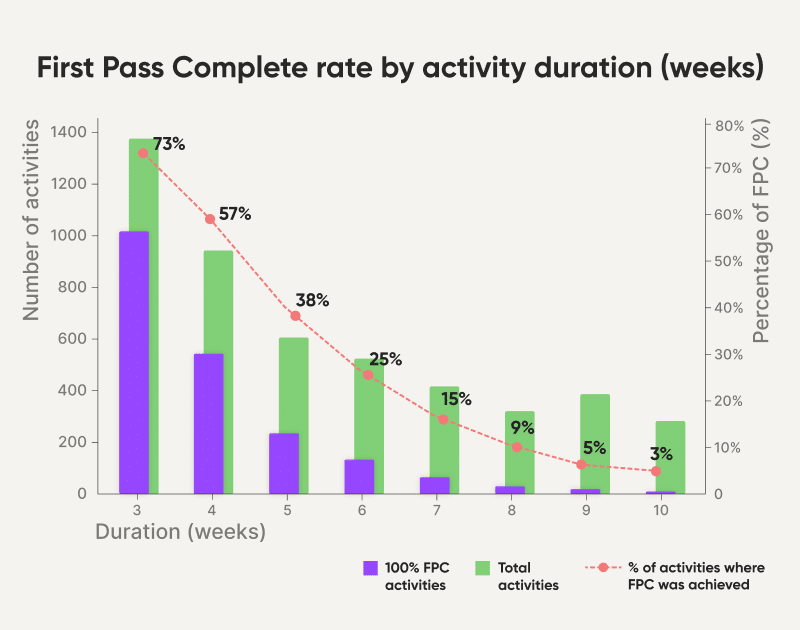

The data points to a specific “tipping point” at the 3-week mark.

The sweet spot (1-3 weeks)

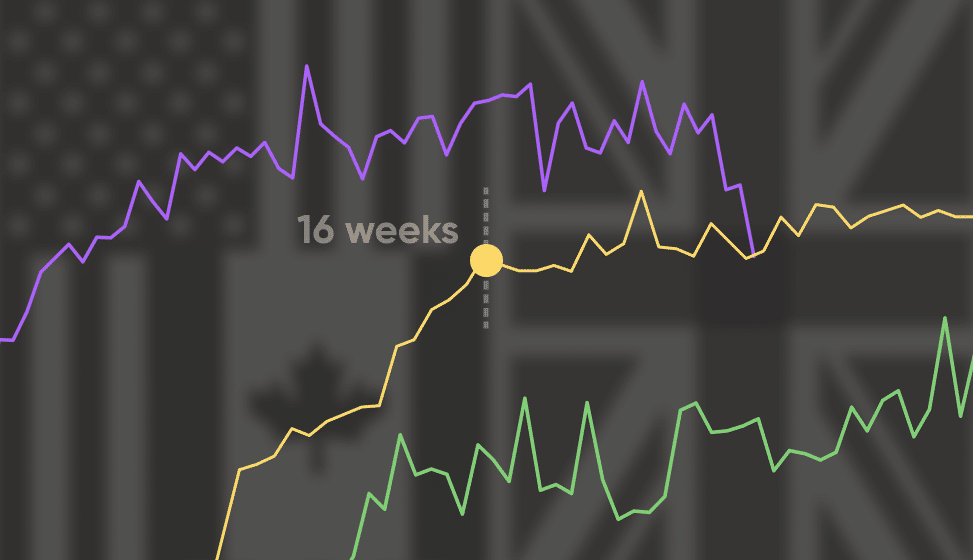

Trades that move from 10% to 90% completion on a floor within 3 weeks have an average First Pass Complete rate of 73%.

The drop (over 3 weeks)

Once work on a floor stretches beyond 3 weeks, First Pass Complete drops sharply – down to 58% for scopes that take 4 weeks, and 35% for those that take 5 weeks.

As always, we want to make it clear that this data is a correlation and may not represent causation! However, it is clear that longer durations are associated with lost momentum or logistical friction. This forces trades into a stop-start pattern of pausing and returning later instead of finishing cleanly in one continuous push.

So, what does this mean for me?

For project managers and superintendents, the 3-week mark is a really useful early warning sign.

If a trade starts creeping toward 3 weeks on a floor, it usually means flow is about to break and the job could slip into a stop-start rhythm. The goal isn’t to push people to “go faster” at all costs. It’s to enable fast movement by removing constraints, so crews can get in, get the work done, and get out without interruptions.

Want construction efficiency insights backed by real data?

Get our best weekly insights, curated into one monthly briefing.